Current Ratio Formula Example Calculator Analysis

QuickBooks Online allows business owners to manage the entire accounting process online, and you can manage your inventory, input your bank statement, and generate financial statements using the cloud. Use QuickBooks Online to work more productively and to make more informed decisions. In most businesses, accounts receivable and inventory are large balances, and these accounts tie up your available cash. Successful cash management requires an owner to oversee accounts receivable balances, inventory purchases, and other metrics. Like most performance measures, it should be taken along with other factors for well-contextualized decision-making.

Table of Contents

Although the total value of current assets matches, Company B is in a more liquid, solvent position. As another example, large retailers often negotiate much longer-than-average payment terms with their suppliers. If a retailer doesn’t offer credit to its customers, this can show on its balance sheet as a high payables balance relative to its receivables balance.

- If a company has to sell of fixed assets to pay for its current liabilities, this usually means the company isn’t making enough from operations to support activities.

- The current ratio is a broader measure considering all current assets, while the quick ratio is a more conservative measure focusing only on the most liquid current assets.

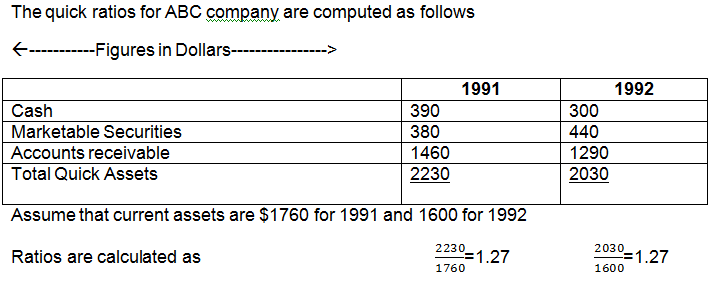

- A more conservative measure of liquidity is the quick ratio — also known as the acid-test ratio — which compares cash and cash equivalents only, to current liabilities.

- We’ll also explore why the current ratio is essential to investors and stakeholders, the limitations of using the current ratio, and factors to consider when analyzing a company’s current ratio.

- The current ratio does not provide information about a company’s cash flow, which is critical for assessing its ability to pay its debts as they become due.

Investor Perspective on Improvement

Therefore, relying solely on the current ratio could provide a misleading sense of a company’s liquidity. Current and quick ratios can help evaluate a company’s ability to meet its short-term obligations. The current ratio is a broader measure considering all current assets, while the quick ratio is a more conservative measure focusing only on the most liquid current assets. The current ratio provides a general indication of a company’s ability to meet its short-term obligations.

Negotiate Better Payment Terms – Ways a Company Can Improve Its Current Ratio

Current assets refers to the sum of all assets that will be used or turned to cash in the next year. Find the best trucking accounting software for your business with our comparison guide. Read about features, pricing, and more to make the best decision for your company. This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves.

If a company’s current ratio is too high, it may indicate it is not using its assets efficiently. This means the company may be holding onto too much cash or inventory, which can lead to reduced profitability. Companies may need to maintain a higher current ratio to meet their short-term obligations in industries where customers take longer to pay. The current ratio can also provide insight into a company’s growth opportunities. A high current ratio may indicate that a company has excess cash that can be used to invest in future growth opportunities.

What is the formula for the Current Ratio?

While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets. Putting the above together, the total current assets and total current liabilities each add up to $125m, so the current ratio is 1.0x as expected. In this example, Company A xero promo code coupons february 2021 by anycodes has much more inventory than Company B, which will be harder to turn into cash in the short term. Perhaps this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet. Company B has more cash, which is the most liquid asset, and more accounts receivable, which could be collected more quickly than liquidating inventory.

Business owners must create a list of key metrics used to manage a company, and that list should always include the current ratio. To work with the current ratio, you need to review each of the accounts in the balance sheet and consider how the current ratio can change. The first way to express the current ratio is to express it as a proportion (i.e., current liabilities to current assets). Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash. In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity. During times of economic growth, investors prefer lean companies with low current ratios and ask for dividends from companies with high current ratios.

Negotiating better supplier payment terms can also improve a company’s current ratio. By extending payment terms or negotiating discounts for early payment, a company can improve its cash flow and increase its ability to meet short-term obligations. However, balancing this strategy with maintaining good relationships with suppliers is essential. The growth potential of the industry can affect a company’s current ratio. Companies may need to maintain higher current assets in industries with high growth potential to exploit growth opportunities. Economic conditions can impact a company’s liquidity and, therefore, its current ratio.

۰ دیدگاه